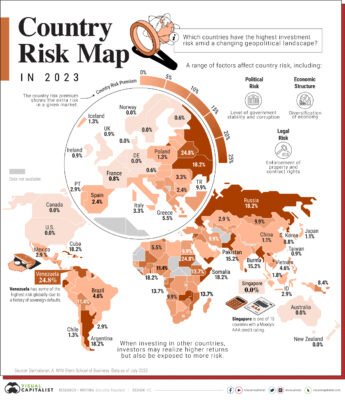

A recent analysis of Country Investment Risk (2023) by Aswath Damodaran at New York University’s Stem School of Business was visualized by Dorothy Neufeld and Sam Parker of Visual Capitalist’s.

Besides a graph, the data is also represented in a table of countries and the Country Risk Premium (in %) for each country with Belarus having the highest risk (24.8%) and the USA, the Netherlands, Luxembourg, Switzerland, Singapore and other with a Moody’s AAA government bonds credit rating, the lowest (0%).

Curacao (2.9%), Aruba (2.9%), and St. Maarten (4.6%) are also mentioned.

The factors that determined the level of country risk include:

• Political risk; the level of government stability and corruption,

• Economic structure; the level of diversification of the economy, and

• Legal risk; Enforcement of property and contract rights.

It is interesting to note that of all the islands in the Caribbean, only Turks and Caicos (2.4%), Bermuda (1.3%) and the Cayman Islands (0.9%) have a lower investment risk.

This raises several questions, the first being why interest rates in our markets remain so much higher compares to other countries with a higher investment risk.

Obviously this information is important for our economies because it can and should be used as a marketing tool to attract foreign investments in order to improve and further diversify our local economies.

We would appreciate your comments as to how we could make use of this information to accomplish this.